Social security wages calculation w2

Free paystub maker tool is specially designed to generate printable pay stubs in PDF format at your Email for easy download share online without repaying. Gross income or gross pay is an individuals total pay before accounting for taxes or other deductions.

How To Calculate W2 Wages From Paystub Paystub Direct

5000 - other contributions that are deducted.

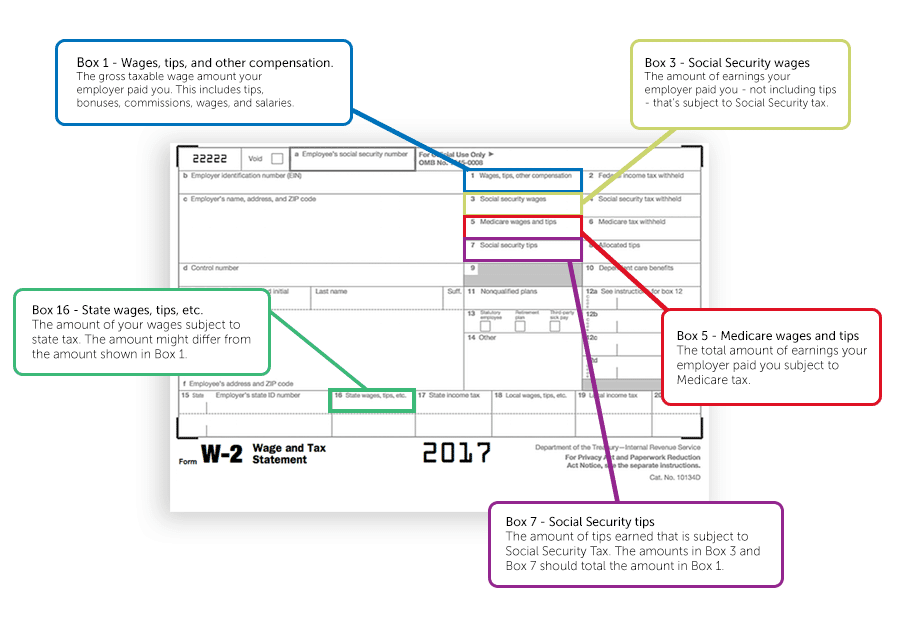

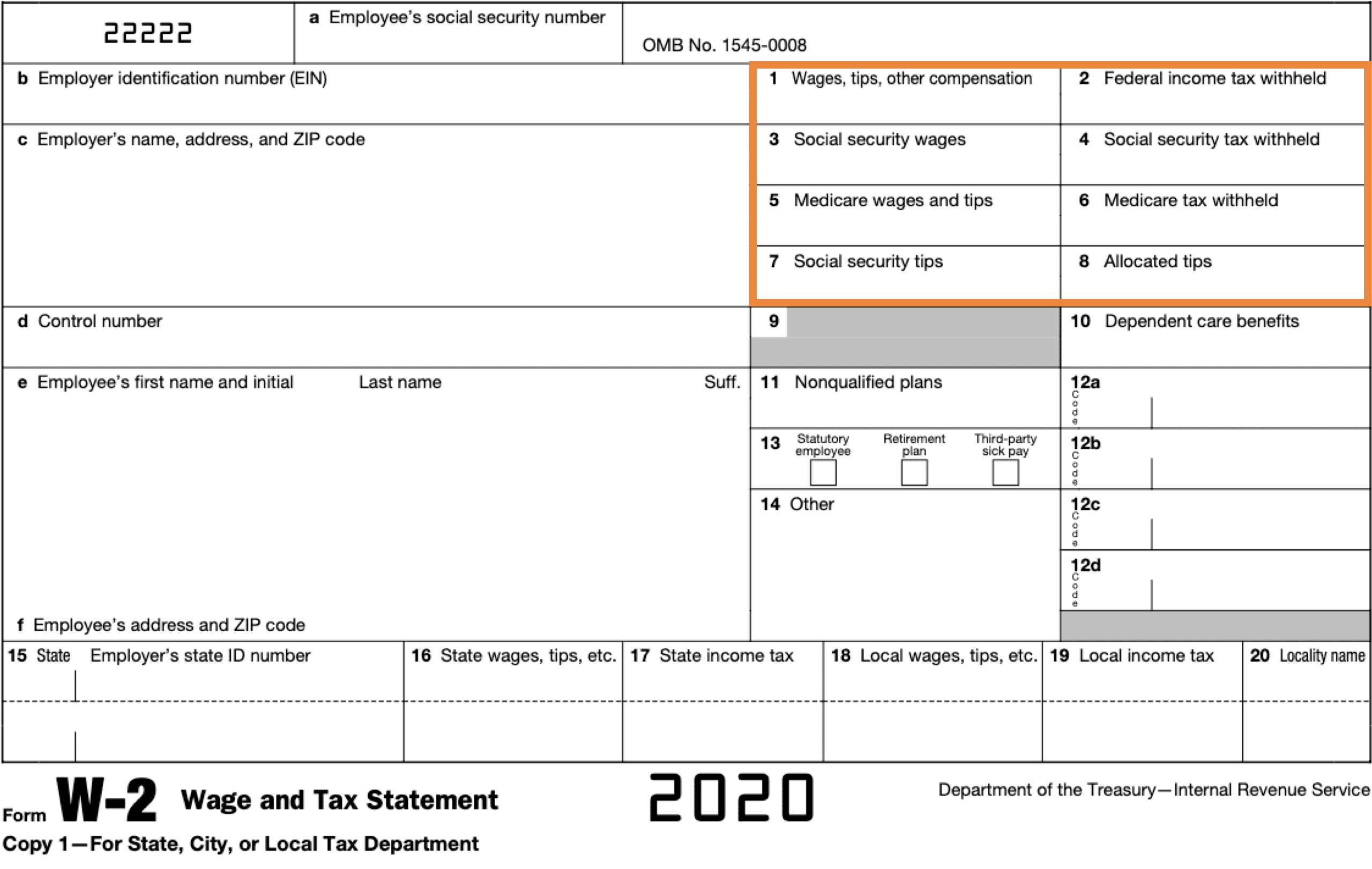

. Yrs 3-4 Political science. The Unemployment Insurance UI tax rate for new employers is 295 percent 0295 of taxable wages. Boxes 3 and 5 show the amount of your earnings subject to Social Security and Medicare taxes respectively.

Try Free Pay Stub creator to generate paystubs without Watermarks online include all company employee income tax deduction details. Calculate the estimated payroll taxes due on wages for both employees and employers. Yearly Federal Tax Calculator 202223.

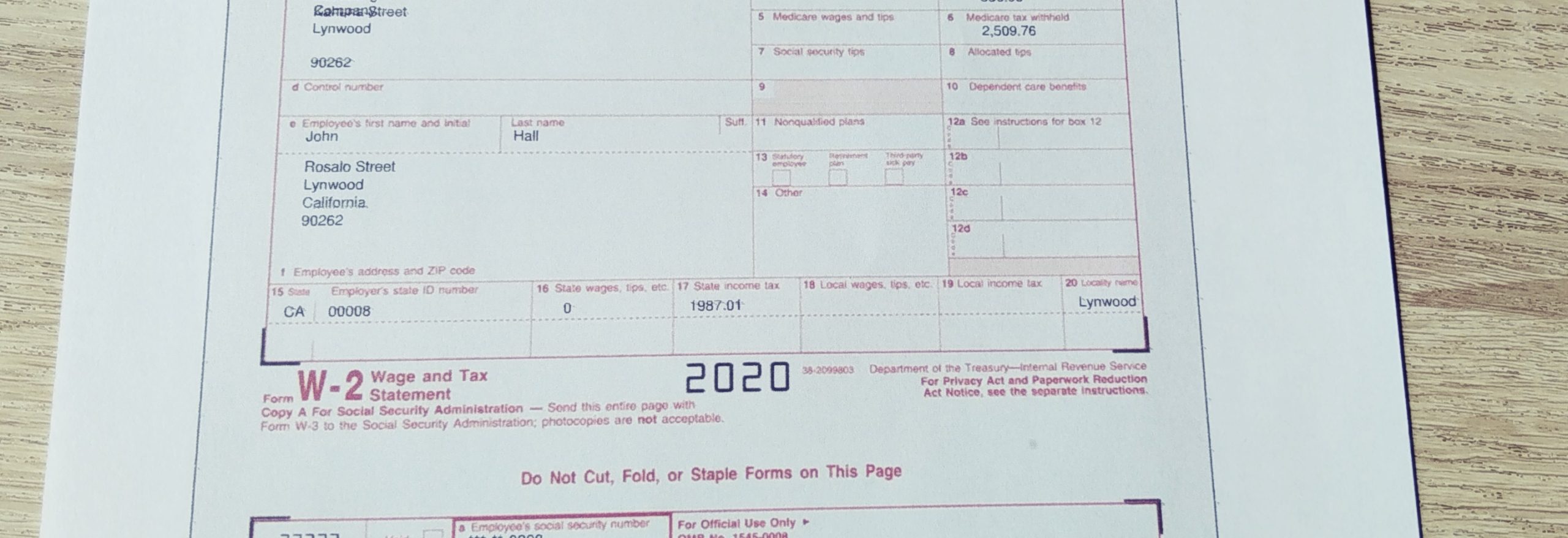

Box 9 Verification code. HOW TO READ YOUR PAYROLL STUB AND YEARLY W2 EARNINGS STATEMENT. Easy to use quick way to create your paycheck stubs.

199A must have been filed on Form W-2 with the Social Security Administration within 60 days after the due date for that filing and must be with respect to employees of the taxpayer for employment by the taxpayer. Social Security Reply Regarding Your Wages SSA-1124 Critical Case SSA-1127 Report Of Purchases. Page 4 of 4 Revised 1242019 Box 6 - Medicare tax withheld.

10000 - other capital gains. The following pages are an electronic reproduction of the Withholding Rules and Regulations Booklet some changes that appear on the electronic version may not be the same as the written version if you have any questions please contact Revenues Withholding Department at 302 577-8778 or bustaxdelawaregov for clarification. The calculated taxable wage figure is based on each individual employees gross wages reported by the employer to this department for the current calendar year.

The wages per employee and refundable credit for 2020 and 2021 of qualified business owners are calculated as follows as per the Paycheck Protection Program. Box 8 - Allocated tips. It is possible to have been overwithheld for OASDI FICA taxes in the event that the total of all W2.

Supplemental Security Income Calculation SSA-4911-U2 Record Of Temp Emp Id Number SSA-4915-U2. Social Security Form W2 Or W2p Information SSA-1151-TEST Medical Assessment Of Ability SSA-1152-TEST. Box 1 shows your total taxable income paid by your employer including any wages salary tips bonuses and other taxable compensation.

If you did not have SSA earnings eg worked outside the United States or do not have a Social Security number then you must provide other documents demonstrating earnings including tax returns statements of profitloss from a business if self- employed W2 forms 1099 forms pay stubs or employment offer letters. The benefit to his eventual SS payout would be replacing a year where his index income was 62261. View this sample Project.

The calculation begins by determining the amount that would be withheld if all the wages were subject to Missouri withholding using the Missouri withholding table. If you deferred the employee portion of social security or RRTA tax under Notice 2020-65 see Reporting of employee social security and RRTA tax deferred in 2020 later for more information on how to report the deferralsAlso see Notice 2020-65 2020-38 IRB. For 2020 the tax incentive is equivalent to eligible individuals eligible income in a month for qualified health plan expenses and health insurance costs up to 5000 per worker as.

Get 247 customer support help when you place a homework help service order with us. This amount is then multiplied by a percent which is determined by dividing the wages subject to Missouri withholding tax by the total wages reported for federal purposes. Note that under each of the methods discussed below qualified W-2 wages for purposes of Sec.

We consider our clients security and privacy very serious. This amount is needed to estimate taxable income for purposes of the QBI deduction calculation. You can quickly estimate your tax return by following the steps in the Simplified Tax Return Calculation below.

Allocable share of W2 wages from business or from A Line 12 Multiply Line 4 by 50 Multiply Line 4 by 25. Lab project Phase 3. When I entered this info into TurboTax get a free refund estimate before filing both of them showed my federal refund at 47.

Calculate Social Security Taxes. Wages paid by an employers predecessor. 5000 - contribution to IRA.

The inclusion of the poor in society 186-216 In union with God we hear a plea. Social Security Taxes are based on employee wages. Social Security Wage Base - 2018.

At the company level its the companys revenue minus the cost of good sold. Communal and societal repercussions of the kerygma 177-185 Confession of faith and commitment to society 178-179 The kingdom and its challenge 180-181 The Churchs teaching on social questions 182-185 II. So he would need to earn wages and pay social security tax on more than 62261 before he retires to improve his benefit AT ALL.

Scenario 3 making more money than last year smaller refund. The good news is that course help online is here to take care of all this needs to ensure all your assignments. 10000 - movement expenses.

You also need to have time for a social life and this might not be possible due to school work. 2022 tax refund calculator with Federal tax medicare and social security tax allowances. For experience rated employers the rates may range from a low of 25 percent to a maximum of 54 percent of taxable wages.

THE SOCIAL DIMENSION OF EVANGELIZATION 176 I. Box 10. View this sample Lab Report.

Wages salaries tips etc. Social Security wages have a maximum taxable income limit of 142800 for the year 2021 which includes qualified employee wages andor self-employment income. Wages reported to another state.

Box 2 shows the total amount of federal income tax withheld by your employer on your behalf. Includes amounts withheld for Medicare taxes and surtaxes. The following may attribute to these figures being different.

Example of a calculation. Form W-2c reporting of employee social security tax and railroad retirement tax act RRTA deferred in 2020. Taxable interest Tax Exempt interest.

55000year - taxable interest. In 1950 both Form W-1 and Form SS-1 which reported Social Security tax withholding were replaced by Form 941 which is used by employers to report both income tax withholding and Social Security taxes. The form W-1 Return of Income Tax Withheld on Wages was the original form used to report Federal income tax withholding.

Last year my wages were around 30000 withheld taxes of 2240 and state income tax was 1500. 15000 - regular dividends. Our records are carefully stored and protected thus cannot be accessed by unauthorized.

There are two components of social security taxes. Lets take the case of an individual with the following situation. At 62261 that requires employer and employee FICA contributions of 722036 plus medicare taxes.

Be sure to check the maximum limit annually since it changes every year to adjust for inflation improve the systems finances and provide reasonable benefits for higher wage earners. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Box 7 - Social security tips.

We do not disclose clients information to third parties.

Fillable Form W2 2015 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Credit Card Services Tax Forms

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Employer Identification Number

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Employer Identification Number

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

A Quick Guide To Your W 2 Tax Form The Motley Fool

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Understanding Your W 2 Controller S Office

Form W 2 Explained William Mary

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Documents Store Payroll Template Money Template Money Worksheets

Your W 2 Employees Help Center Home

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center