30+ mortgage deduction calculator

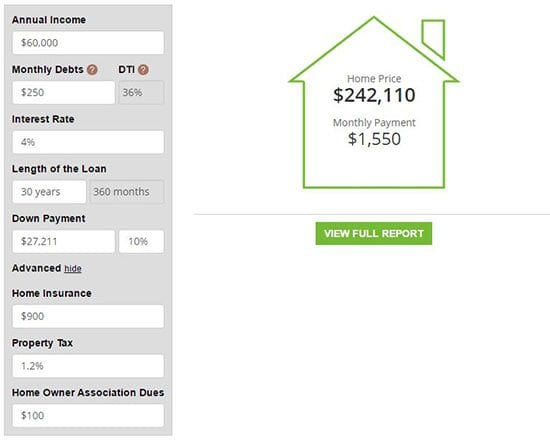

Web Mortgage interest. Web To determine what type of mortgage works better for you and compare your total costs simply plug in the total cost of the home your expected down payment.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Web 5 hours agoThe FHAs 30 bps cut will reduce housing costs by an average of 800 for roughly 850000 homebuyers homeowners in 23 the White House said.

. Web Answer a few questions to get started. But for loans taken out from. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

Serving All Of Arizona. Ad Earn Up To 2 000 In Tax Credits Annually For The Life Of The Mortgage. Mortgages are how most people are.

This calculator is for general education purposes only and is not an illustration of current Navy Federal products and. Enter your info to see your take home pay. However higher limitations 1 million 500000 if married.

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. This is an increase from the previous week. Web 1 day ago30-Year Fixed Mortgage Rates.

Ad Start Using Our Online Mortgage Calculators To Calculate Your Monthly Payment. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Use this calculator to see how much you could save.

Web 1 day agoThe average interest rate on the 15-year fixed mortgage is 617. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on. This same time last week the 15-year fixed-rate mortgage was at 604. Web In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages.

Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. The current average 30-year fixed mortgage rate is 632 according to Freddie Mac. On a 15-year fixed the.

Web 3 hours agoThe MIP will be reduced from 085 to 055 for most homebuyers seeking an FHA-insured mortgage which could mean an estimated savings of 678 million for. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly.

Mortgage Tax Savings Calculator

5 Mortgage Calculator Features You Are Not Using But Should Mortgage Rates Mortgage News And Strategy The Mortgage Reports

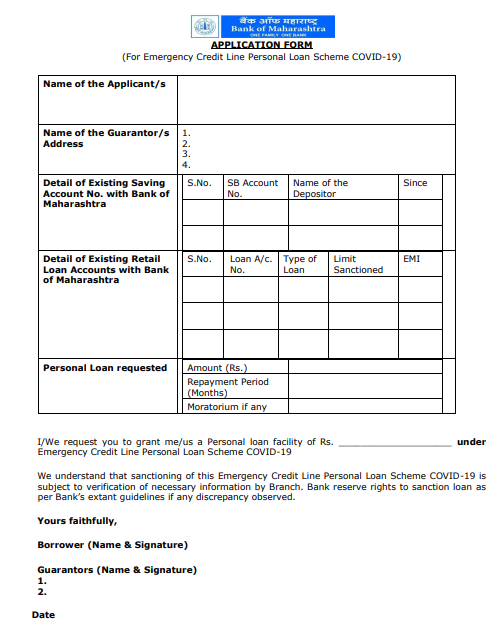

Bank Of Maharashtra Covid 19 Personal Loan Eligibility Interest Rate Documents

Which States Benefit Most From The Home Mortgage Interest Deduction

How To Pay Off The Mortgage Early 30 Methods You Can Use Right Now

Free 9 Mortgage Payment Calculator Templates In Pdf

Mortgage Payment Tax Calculator Deduction Calculator

:max_bytes(150000):strip_icc()/Employee-retention-credit-25270655c72840d5ab9012169ef9e21d.jpg)

The End Of The Employee Retention Credit How Employers Should Proceed

Serving The Citizens Not The Bureaucracy A Strategic Vision For City Procurement Digital Benefits Hub

Some Mathematics Of Investing In Rental Property Floyd Comap

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

How To Calculate Your Fire Number When You Have A Mortgage With Spreadsheet R Financialindependence

Excel Nper Function With Formula Examples

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Mortgage Payment Tax Calculator Deduction Calculator

Cryptocurrency Tax Calculator Startup Stash